Donation Options

AZTECH Robotics does not receive budgeted dollars from the school. Funding for the team comes from club dues, tax credit donation, grants, sponsorships, and your involvement with fundraising. Funds cover outreach event costs, competition fees, robot parts, equipment, travel costs, food for students throughout the year, and more! Did you know that a robot can cost on average $10,000 to build?

Individual Donations

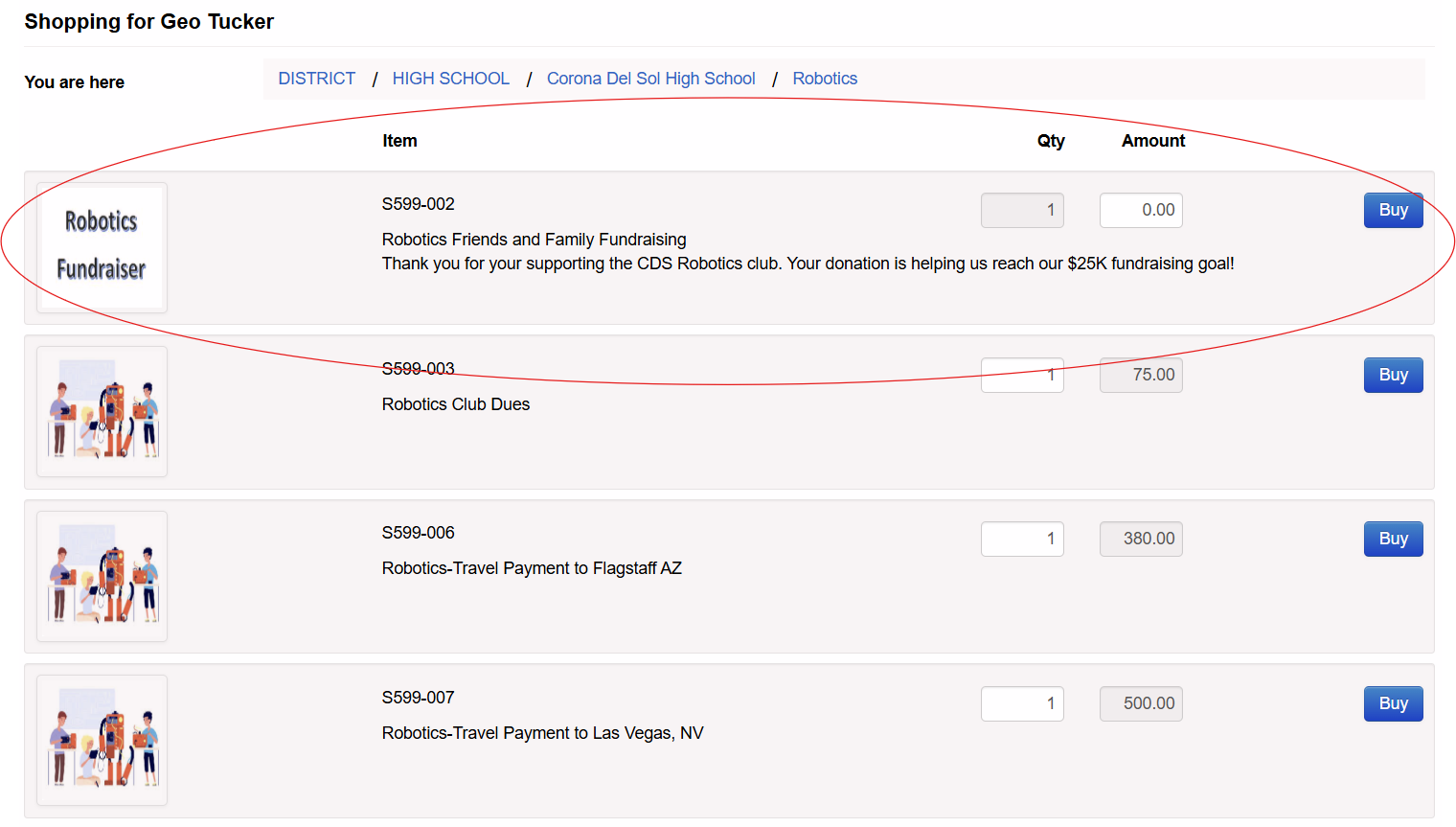

Available through our school bookstore, you can make individual donations! It is called the Robotics Friends and Family Fundraising, and all donations go directly into our accounts to continue to build robots and strengthen our local community.

If you are running into issues with the bookstore, scroll to the bottom of this page for a step-by-step guide!

Arizona Tax Credit

The easiest way for us to raise funds is through tax-credit donations. If you have not already taken advantage of donating in 2025, you may do so online or through the CDS Bookstore before April 15th, 2026.

The Arizona Tax Credit Program (A.R.S. 43-1089.01) allows any Arizona taxpayer to donate up to $400 to a school of their choice in support of extracurricular programs and get their entire donation back in the form of a tax credit! Individuals and couples filing jointly may take advantage of this tax credit. A maximum of $200 can be deducted per individual tax return; couples filing a joint return may deduct a maximum of $400. Information about the credit may be found here:

Arizona Department of Revenue Guidelines: The credit is applied against the taxpayer's state income taxes.

"Extracurricular activities" are defined as . . . "school-sponsored educational and recreational activities that require enrolled students to pay a fee in order to participate."

Checks must be made payable to the school. Credit cards may be used in person at the bookstore or online

The credit is available for any personal income tax return. It is not a requirement that the taxpayer have a child enrolled in the public school. (Opportunity for friends, neighbors, family, coworkers, etc.)

The credit is limited to $200 per individual tax return and $400 if the credit is claimed on a tax return of a married couple.

If you are interested in donating to our team, please visit https://az-tempeunion.intouchreceipting.com. Be sure to select "T599-001 TAX CREDIT - ROBOTICS" found under District>High School>Corona Del Sol High School>Tax Credit Donations

Corporate Sponsorships

You can secure employer sponsorships or grants. Look into your employer's support for student activities. In the past, we have had corporate support from Boeing, General Dynamics, Viasat, State Farm, Teletech, Marvell, and other local companies. Feel free to provide them with our sponsorship letter attached HERE.

We are also always looking for mentors! Mentors are adults on the team who have experience in the industry, whether that be engineering, business, public relations, or something else entirely! If you are interested in becoming a mentor and teaching the next generation, please email contact@team6479.org.

Our bookstore can be confusing, use this step-by-step guide to make your own donation!

Navigate to the link, https://az-tempeunion.intouchreceipting.com/, and then click the button called “click here to create guest account”

Then, fill out the guest user information.

After creating a guest account, you will be sent an email verification. Click the verification button in this email to proceed.

Now you’re ready to donate!

Now click the button titled “Items at all Schools”

Then Select High School, then Corona del Sol, and then Robotics

Now add the item entitled “Robotics Friends and Family Fundraising” to your cart by selecting buy and proceed to checkout in the upper right corner.